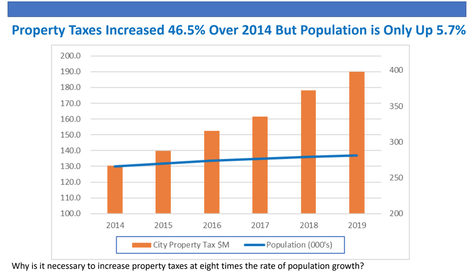

During public testimony this week, Jamee Jolly claimed the chamber’s member businesses support the city’s proposed property tax The following article is by Ross Kecseg of Empower Texans. Plano's Political Pit Bull adds to the article at the bottom. “This week, the head of the Plano Chamber of Commerce came out in support of the city’s proposed 4.5 percent property tax hike. If approved, the average Plano homeowner will see a 40 percent increase in their city tax bill in only five years. At Monday’s city council meeting, officials conducted the first public hearing on the city’s proposed tax hike. State law requires cities to hold two public hearings when proposing a tax increase. More than 40 citizens expressed opposition to the tax increase at the meeting. In addition to half a dozen speakers opposing the tax increase with persuasive testimony – including Mark Reid of the Plano Citizens Coalition –more than 570 petitions from residents were presented to council asking them not to raise their city tax bills. Over the past four years, the average Plano homeowner has seen their city property tax bill increase by 36 percent, according to city records. If passed, the proposed increase would push that figure over 40 percent in just five years. Higher city taxes are the result of council failing to reduce its city tax rate enough to offset skyrocketing property values. The city makes up roughly 20 percent of the average homeowner’s total property tax bill. Jim Dillavou, a Plano resident and retired CPA, gave compelling testimony when he cited city data comparing the city’s tax revenue growth to its resident population. While city property tax revenues have increased 46.5 percent since 2014, Plano’s resident population has only risen 5.7 percent. Dillavou asked, “Why should tax revenue rise eight times faster than the city’s population?” Only four individuals expressed their support for the tax increase, including Plano Chamber of Commerce President and CEO, Jamee Jolly. Jolly suggested her member businesses consider the proposed tax hike an “investment.” No business owner was present to speak on behalf of the increase. Jolly also referenced a “survey” of Plano residents that indicated they were satisfied with city services.” In this humble Pit Bull's opinion, Jolly's claim that her members want a property tax increase is ridiculous. If this is true, Jolly and Plano business owners need an economics class. If business property gets a tax increase, they must pass that increase on to their customers with higher prices. Higher prices mean customers buy less, or go to a cheaper competitor. Jolly has also forgotten that the more residents have to pay in taxes, the less disposable income they will have. The less money residents have, the less they will spend in businesses. So why would Jolly be in-favor of higher taxes? In two words: economic development. Jolly wants hand outs for large corporations who want to come to Plano; however, these handouts and higher taxes reduce customers' income. One would think the President of the Chamber of Commerce would care more about her members and their customers then moving in the competition. This is Plano's Political Pit Bull Signing off.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

|