|

That taxpayers are funding their own opposition is egregious, and should stop.

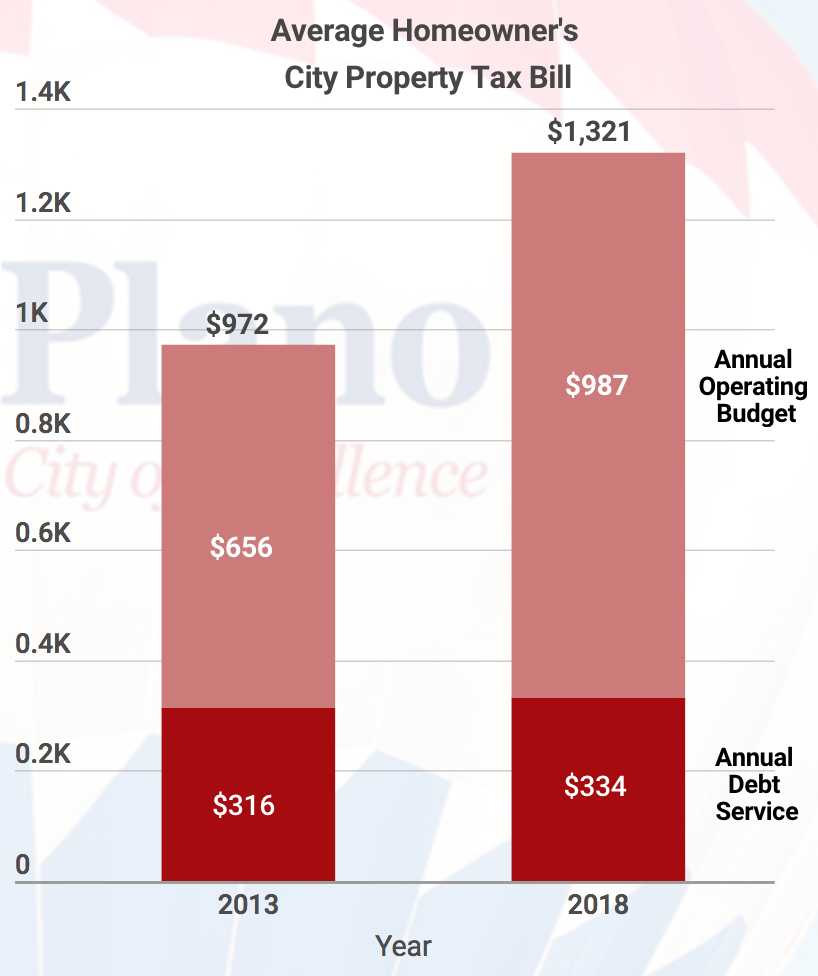

October 26, 2018 by Salvador Ayala From Empower Texans Contempt for Plano taxpayers is on full display after a recent item on the city council’s consent agenda raised eyebrows among residents. The controversy stems from “Item R” on the October 22 agenda, which appears to authorize the city manager (or their designee) to engage in lobbying activities on behalf of the city. While lobbying is a normal function of government, the practice of using taxpayer dollars for lobbying is generally frowned upon by constituents. Even more so when that lobbying promotes anti-taxpayer measures, as is the usual case. That agenda item reads as follows: “To adopt the 2019 Legislative Program for the City of Plano, Texas; directing the City Manager or his designee to act with regard to the City’s 2019 Legislative Program.” Unsurprisingly, the city’s 2019 Legislative Program makes clear that maximizing the taxing authority of the city is paramount, and seeks to “protect municipal revenue such as property taxes, sales taxes, right-of-way revenues, service fee, and court fines.” Largely due to skyrocketing property values, property tax bills go up concurrently when a city refuses to adopt the effective tax rate—the rate that would keep your bill the same as last year. Rising property taxes are putting people out of their homes, and curtailing their growth has become a top issue in the state. In fact, just last month Plano City Council approved a 4.5 percent tax hike. In a 5-3 vote, the council ensured that the average Plano homeowner will see a 40 percent increase in their city tax bill over five years. During the last legislative session, measures were offered that would empower voters with an automatic tax election when cities raise their taxes by four percent or more. Though they met with defeat in the Texas House, the governor and many lawmakers plan to revive those reforms in the coming 86th session. It stretches credulity to claim that a city employee lobbying against tax reform is in any way beneficial to taxpayers in that city, especially when it comes to property taxes. That Plano taxpayers are funding their own opposition is egregious, and should stop. Ironically, as bills are also filed to combat the practice of tax-funded lobbying, government employees and officials like Plano’s city manager can be expected to lobby against those reforms on the taxpayer’s dime as well.

1 Comment

On the Consent Agenda for the Monday, October 22, 2018, City Council meeting is a resolution to lobby the state and federal legislatures. The item on the agenda reads as follows, "To adopt the 2019 Legislative Program for the City of Plano, Texas; directing the City Manager or his designee to act with regard to the City's 2019 Legislative Program." Right now you are probably asking, what the heck is the Legislative Program? This is a list of items that the City supports or opposes. The resolution instructs the City Manager to "actively pursue passage of the appropriate legislation [the City supports]", and to "impede the passage of any legislation [the City opposes]." Simply put, the City wants to send Bruce Glasscock to lobby the state and federal governments. So, who gets the privilege of paying for this lobbying? You, of course. One of the items on the City's support list is "legislation that protects municipal revenue such as property taxes." Now we have a problem. To read the full resolution and Legislative Program go to

file:///C:/Users/jsgro/Downloads/GOVT102218-01Resolution.pdf and file:///C:/Users/jsgro/Downloads/GOVT102218-02Exhibit_A.pdf Residents across the state of TX and the city of Plano have been complaining about the rise in property taxes. If you have read this site before, you know that the Plano City Council has raised property taxes over 40% in five years. For the past two years, residents of Plano have gone to the City Council begging them not to raise taxes. Sadly the City Council has ignored these pleas. Plano residents are not alone when it comes to being ignored by their city councils; many other cities in Texas face the same issue. Naturally, Texans were not going to let City politicians and bureaucrats stop them. Residents went to their state representatives for help, and in response, Plano and Collin County reps are working with the Lt. Governor and Governor to pass legislation to halt or slow the rise of property taxes. One idea that has come from this is letting the residents vote if a city raises taxes more then 4%. This would let residents decide if they want their taxes to go up. Of course, the city is against any proposal that would limit the amount they could raise taxes. They clearly don't care that residents are suffering from the tax increases. Hence, the city is more than happy to spend our tax dollars to lobby the government on this issue. The fact that a city would spend residents tax dollars lobbying against its own people is morally reprehensible. This is akin to gun control groups being forced to pay the NRA to lobby against gun control legislation. Therefore, a city should not be able to lobby against its own residents with tax dollars. If Bruce Glasscock or the Mayor want to lobby against the people they serve, they should do it on their own dime. If you are against the city using your money to lobby for higher taxes go to the meeting, fill out a card to have the item 'r' removed from the consent agenda, and speak against it. In fact, this should not have been put on the consent agenda in the first place. That is supposed to be for items that are not controversial, and taxes are definitely controversial. Write to the members of the City Council and to your state reps as well. Tell your TX reps to ignore the lobbying from Plano staff on property taxes. The only people they should be listening to are the residents of Plano. You can also call the City Secretary's Office at (972) 941-7120 to have a speaker card filled out or register your opinion for item 'r' on the consent agenda if you can not attend the meeting. City Council Members Angela Miner: [email protected] Anthony Ricciardelli: [email protected] Rick Grady: [email protected] Kayci Prince: [email protected] Ron Kelley: [email protected] Mayor LaRosiliere: [email protected] Tom Harrison: [email protected] Rick Smith: [email protected] State reps. Van Taylor - [email protected] Matt Shaheen House District 66 - [email protected] Jeff Leah House District 67- [email protected] HD 89 will definitely have a new rep for the next session. I would wait until after the Nov election to email the winner. This is Plano's Political Pit Bull signing off. by A. Vindex

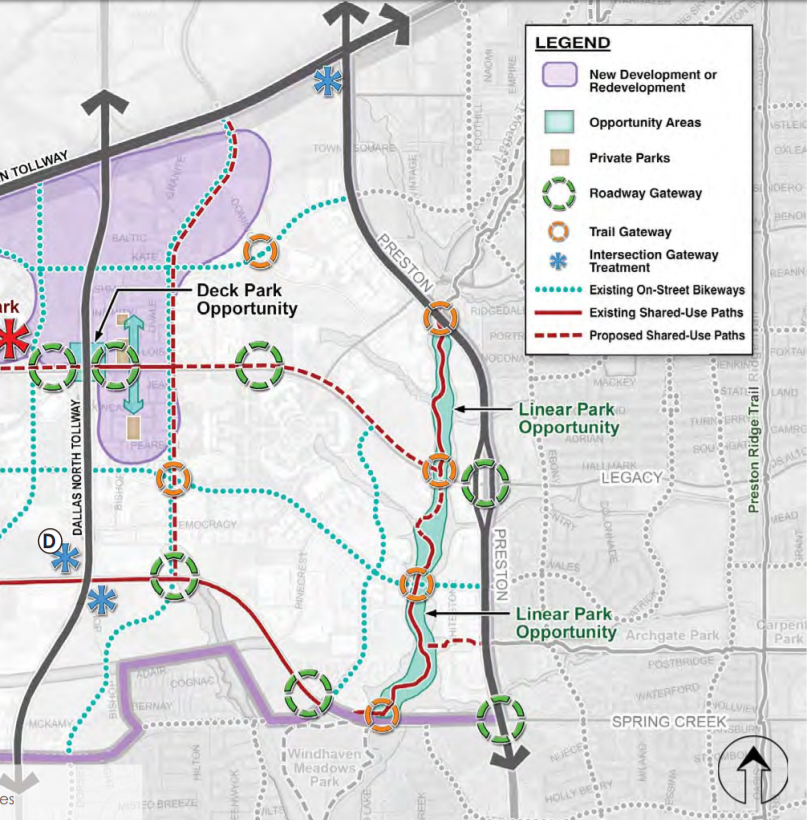

On Monday, October 8, 2018, the Plano City Council passed the Master Park Plan. This is a massive bureaucratic central plan that is updated every five years. The plan is a whopping 260 pages. In contrast, the Constitution is 19 pages. One makes a more perfect union and the other plans for future parks. The Declaration of Independence is two pages, not including the signatures. It declares the colonies free states, while the other plans for future bike trails and pickleball courts. If you want to see the plan go to the city's website http://www.plano.gov/DocumentCenter/View/32546/DRAFT-Park-Master-Plan?bidId= If you would like to see what happened at the city council meeting go to http://planotx.swagit.com/play/10092018-520 This master plan is the third Plano bureaucrats have made, and the council has passed in the past few years. This latest bloated plan, that would make any progressive giddy, has me pondering two questions. What is a local government necessary role? Is it governments responsibility to entertain us? To answer these questions let us take a hypothetical. Suppose a small group of people were to start a new town. They have their houses, well water, and septic already. With those basic needs taken care of, what is one of the first thing this new town would need? Most intelligent people would say a Constitution. The next thing residents would need is a police department, so it could keep its residents and their property safe. This role of government comes from John Locke who said, "The great and chief end, therefore, of men's uniting into commonwealths, and putting themselves under government, is the preservation of their property." This role is also in the words of our US Constitution, "Establish Justice, insure domestic tranquility, provide for the common defense, .... and secure the Blessings of Liberty" The next thing the townspeople would need is a fire department. This hypothetical town would also need a Mayor and Council. It would also want judges and prosecutors to try criminals and settle civil disputes. The people would also need a department to create and maintain roads and collect trash. Those are the basics items every local government would have to provide its residents. Did you notice what was not on the list? Parks, recreation centers, a golf course, pools, trails, and even libraries were not on the list of needs for our hypothetical town. That is because those items are not necessary for a town to function. To that point, the Plano library system was first created in 1965, 92 years after Plano incorporated in 1873. The first park was built in 1925 privately by The Plano Lions Club and the Haggard family. They name it Haggard Memorial Park. So, for 52 years Plano did not have any parks, but it continued to survive and thrive. The Parks and Rec. department was not even established until 1968. Yet, Plano continued to grow more than 35 times its population from incorporation. Today, however, Plano has over 60 parks, 9 trails, 7 rec. centers, 1 golf course, and 3 pool centers. Even though we can clearly see from our own history that Parks and Rec. are not the basic functions of government and not therefore necessary. Yet some people say over 60 parks, 9 trails, 7 rec. centers, 1 golf course, and 3 pool centers are not enough; hence, the "need" for a plan. But, we also need money; parks, pools, rec. centers, and golf courses cost a lot of money to build, run and maintain. The Parks and Rec. department has a budget of $29.63 million. Each recreation center cost millions to operate and maintain. For example, the Tom Muehienbeck Center will cost us 1.91 million in 2019, and the Liberty Recreation Center will cost $1.06 million. That money will come from taxpayers. Some of you might be saying, "Wait, the rec. centers are not free; if a resident wants to use them they have to pay a fee." In that aspect, you are correct, for there are fees to use the centers. However, these fees only cover 4.17% of the cost to operate and maintain the centers. If these were private clubs, they would have gone out of business long ago. The responsible and fair thing would be for the center's fees to at least cover their operating costs. This would alleviate some of the burdens these centers are putting on taxpayers. Some, who don't use the rec. centers at all. This brings me to my last question, Is it governments responsibility to entertain us? We can find evidence of government entertaining its citizens as far back as 140 B.C.E. during the Roman Empire. Roman politicians passed laws to keep the votes of citizens. Lawmakers introducing a grain dole: giving out cheap food and entertainment, "bread and circuses", became an effective way to rise and keep power. Basically, keep your voters fat and entertained, and they will vote you back into office. The bread and circuses were also used to distract residents from the problems the government was facing. Fast forward to today and local governments support all kinds of forms of entertainment and build buildings to house the entertainment instead of letting the private sector do it. Think of these as the modern-day coliseum. Over the years politicians have approved government run rec. centers, pools, and parks for every part of Plano, so residents don't have to travel far to access these "coliseums". City Council officials have also approved government owned event centers, theaters, and pavilions. Politicians have given taxpayer money to help fund a multitude of festivals or "circuses". Some examples are The Plano Balloon Festival, The Plano International Festival, and the Art and Music Festival. All so residents can be entertained and politicians can say, "Look at what we did; vote for us. " Now, Plano residents have become conditioned to expect the government to fund their entertainment. Instead of going to private businesses, people are going to the government demanding it. Residents go to the City Council demanding more museums, more parks, more trails, and even pickle-ball courts. Where will the money come for this entertainment? The taxpayer of course. Those who want these things are overjoyed when politicians kowtow to their demands; while those who don't want or use these things are forced to pay for them in rising tax bills. Those folks would like to know why they should pay for entertainment they don't want or participate in? These people want to know when entertainment became a necessity? Of course, it never did. Let us go back to my hypothetical town. Entertainment was not on the list of departments that a starting town would need. As I have outlined, for most of Plano's history, residents did not require the government to entertain them. Why? Because they knew what the government was for. This role is outlined in the US Constitution and Declaration of Independence. They knew governments' role was to protect its resident's life, liberty, and property and not to distract the people with bread and circus. The Parks and Recreation Master Plan Should be Tabled at the october 8th city council meeting10/7/2018 By Plano Citizens' Coalition On October 8, the Plano City Council will consider the Parks and Recreation Master Plan which was recently advanced by the Planning and Zoning Commission. The plan contains numerous proposals for new projects and additions to existing parks, some of which will undoubtedly require massive, multi-million dollar expenditures. Due to the excessive nature of the ideas contained within the plan and the likelihood that it will result in budgetary strains, the City Council should table the plan and instruct the City Staff to reevaluate the Parks and Recreation Master Plan on a “wants vs needs” basis. The two largest projects are a proposed deck park that would be constructed over the Dallas North Tollway in West Plano and a pedestrian bridge to connect the Downtown and Collin Creek Mall areas that would be built above US75. The deck park would be similar to Klyde Warren Park, which cost roughly $115 Million. The Parks and Recreation Master Plan anticipates that Collin Creek Mall will be redeveloped in the near future, and thus uses this as a justification for interconnection between the two sides of US 75. The plan notes that this project would be similar to the Continental Avenue Bridge in Dallas, which began as a large, six lane wide roadway bridge. The plan did not provide any estimation as to what the cost of these two large projects would be. However, given the magnitude as conceptualized in the above images, it is certain that new bonds would have to be approved by the Plano electorate. As neither of these lavish projects fit the description of "usual and customary parks", why should the City (that's you and me) pay for it? Shouldn't the developers, whose nearby projects will be enhanced by these expenditures foot the bill? Once again, the city is picking winners and losers, instead of letting the free market compete. Proposals for new parks throughout the city were also present within the plan; notably, such “opportunities” are located in West Plano in the vicinity of the Legacy area, the Downtown area, and along the George Bush Turnpike on the southeast edge of Plano. Currently, these regions are exempt from a requirement in which developers must pay a fee to be used in the acquisition and construction of new parks. The need for these new parks is attributable to the recent addition of numerous multifamily units. Parks constructed without contribution through the developers’ fee will come at a higher cost to the taxpayers throughout the city.

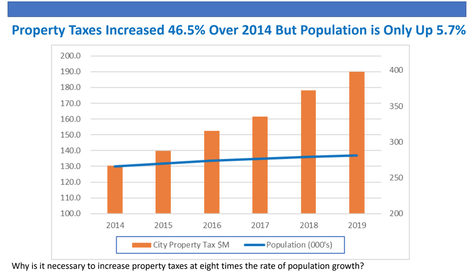

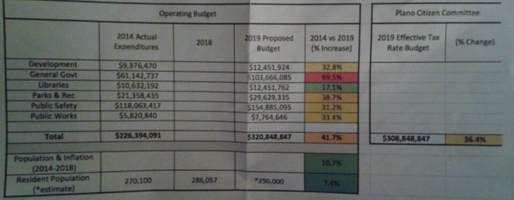

As previously mentioned in past news stories, the City of Plano has also expressed an interest in unearthing the creek which presently flows underneath the Collin Creek Mall parking lot. This is thought to require roughly $50 Million. The re-exposed creek would also be landscaped and utilized in the form of open space adjacent to a redeveloped Collin Creek Mall. Again, unless the City has a plan for recouping the cost through sale of the creek, let the developer pay for this enhancement to its adjacent property instead of the taxpayer. If this plan is approved, key aspects will eventually be included in the Community Investment Program Budget. The CIP Budget is a five year plan meant to address the City’s infrastructure. Included within the CIP, is anticipated spending on parks and recreation. Most of the revenue in the CIP budget comes from bonds that were approved by voters. With this in mind, the proposed Parks and Recreation Master Plan Would almost certainly have a large impact on the CIP Budget. This means that the Interest and Sinking tax rate (a portion of the overall city property tax rate) which funds the debt service could potentially rise if enough new bonds are approved, thus contributing to the continuing trend of residents having to pay higher property taxes. It is difficult to ascertain the potential for tax increases without any cost estimations from the Parks and Recreation Master Plan. The City Council should table this plan in its current form so that it can be revised to prioritize the needs of existing parks and amenities, both in their ongoing upkeep, as well as their repair. Rather than just listing ideas for new projects, a transparent effort must be made to inform the public of the practical impact the plan would have on the CIP Budget and ultimately on the property tax rates to which residents are subject. A carefully formulated plan must also take into account how projects will continue to be paid for upon implementation. Developers must be expected to contribute when applicable as they have done so in the past. Lastly, City Leadership must keep in mind that the issuance of debt should be a tool to ensure that infrastructure can be adequately provided at the present time of need, and it should not be squandered for the sake of vanity or a desire to earn awards for projects that benefit only small segments of taxpayers. Speak or Register in Opposition at Monday's Council Meeting Call the City Secretary's Office at (972) 941-7120 to have a speaker card filled out or register your opinion on Item No.4, Consideration of the Parks and Recreation Master Plan. Contact the City Council Angela Miner: [email protected] Anthony Ricciardelli: [email protected] Rick Grady: [email protected] Kayci Prince: [email protected] Ron Kelley: [email protected] Mayor LaRosiliere: [email protected] Tom Harrison: [email protected] Rick Smith: [email protected] On Monday, September 10, 2018, the Plano City Council Voted 5-3 to raise residents property taxes 4.5% and pass the budget as is. Councilmen Ricciardelli, Smith, and Harrison all vote against the tax increase. Even though over 1000 residents signed petitions, called, emailed, and spoke out against the tax increase, Council Members Miner, Kelly, Grady, Prince, and the Mayor voted to raise property taxes. (Miner, Kelly, and Grady are up for re-election in May of 2019). When comments were confined to council, each member (except Tom Harrison) gave remarks. Councilman Ricciardelli decided to vote against the tax increase because of something one resident said during the second public hearing. At that hearing resident Amy Rattleff said that while the city is asking for an increase her families' wages won't be going up. Councilman Ricciardelli found that while General Funding for the city has gone up 35.9% from 2009-2017, residents wages have only gone up 11.3% in the same time frame. This disconnect is not sustainable, and residents will be forced out of Plano. Councilwoman Prince spoke next. She sees this vote as a long term decision, and feels in order to repair our aging city and maintain our services, she has to vote for the budget and tax increase. Perhaps she missed all the wasteful things that were in the budget, and the items that never get spent year after year? Councilman Smith felt the council could do a better job with the budget and saving money. I guess he did not miss the items Prince did. He also thanked the Citizens Budget Committee for the months of work they did looking at the budget. Councilwoman Miner read from a prepared statement. She passed the blame for higher property taxes to the Collin and Denton County Appraisal Districts. She said, “It is not the city of Plano who is raising your taxes, it is the appraisal districts.” I sometimes wonder how this woman got elected; then I remember she did not have an opponent in her election. Yes Ms. Miner, the appraisal districts set the value of homes, but city council decides how much tax it will place on that value. Only City Council can raise or cut taxes; the appraisal districts have nothing to do with how much money the city takes from the residents. Councilwoman Miner also tried to distract from the city tax issue by talking about PISD and recapture. Yes, PISD does tax the residents. Yes, the state takes billions of dollars from PISD to give to other cities. Plano's state legislatures have tried to end recapture (Robin Hood) or change it. The problem is our guys are out voted. You see, more cities get recapture money then give it. I don't know a single politician crazy enough to vote to cut money that their schools get. Even so, Plano residents still complain to their state reps about recapture. However, Ms Miner, PISD has nothing to do with city taxes. She could have lowered the residents city tax bill; that would have saved the residents money, but she decided to increase the peoples' tax burden. Councilman Grady read from a prepared statement as well. He talked about the petition that residents fill out to try and convince council not to raise taxes. Councilman Grady said that some of the signers were renters and should be excluded. Apparently Mr. Grady does not know that landlords pass their property taxes on to their renters in the monthly rent bills, so when a landlord's property taxes go up, so does the rent bill. Councilman Grady also said that multiple petitions from the same address should not count. So, Mr. Grady thinks that only one person per household should be allowed to fill out a petition; he basically feels spouses should not be aloud to voice their opinions. Perhaps he thinks only one person per household should be allowed to vote too? Councilman Grady did make one good point, however. He supports policy discussions on the budget and tax rates between October and January. Councilman Ricciardelli suggested the same thing when he was giving his comments, but the Mayor stopped him, and told him to stick to the 2018/19 tax rate and budget. Apparently the Mayor likes Grady more then Ricciardelli. Councilman Ron Kelly also read from a written statement. “Whenever you see explosive growth, costs go up.”, he said in order to defend his vote for the tax increase. But, wait a minute; when the council wants to vote for more growth they say that it will help reduce property taxes. So, which is it? Does growth increase property taxes or reduce it? According to the council's tax increases over the last five years, growth raises property taxes. Councilman Kelly also said, “We have an aging infrastructure that needs fixing.” That is a valid point, until you remember that the residents passed a $94 million bond for street repairs in the last local election. Where did that money go? All of our streets have not been repaired, and some street repairs have started but are no where near finished. Apparently we have run out of that bond money because in May 2019 the city will be asking residents to vote on more bonds. Councilman Kelly also commented on the fact that by voting for this tax increase he will be breaking a campaign promise. He said, “My job is to govern not to be political.” In other words, Councilman Kelly's promises are worthless. Some would even say he lied. For those reasons, I don't think residents who supported Councilman Kelly in his first election will be supporting him again. The last person to speak was the Mayor. He started his comments by insulting residents. “We have a self appointed citizens budget group that decided they had the capabilities to run a $750 million budget. Maybe if you use to be a CPA doing tax returns you can run a city budget, or if you're someone who cares you can run a city, inaccurate!”, he said. Excuse me Mayor, if a CPA, a CFO, business owners, an economics teacher, and MBA can't understand a city budget, how the heck can you?! You, Mr. Mayor, have a Bachelor of Science in Geology, so don't insult residents ability to understand a budget. If the Mayor thinks the budget is too difficult for residents to understand, then he should tell staff to make it reader friendly. The Mayor also took time to attack Empower Texans and its representative Ross Kecseg for helping facilitate the petition. The Mayor said, “We have Empower Texans who has made a visit to set their sites on how unappropriated we are to manage our funds. Low tax rate, low debt is their mantra, we have both. So Mr. Ross maybe after this meeting you can tell us what your problem is with Plano.” Mr. Ross Kecseg tried to answer the Mayor's question, but the Mayor cut him off. So, for another year City Council raised residents' tax bills. If this trend continues Plano will be a city that only the rich can afford, and the City Council will only have itself to blame. This is Plano's Political Pit Bull signing off. The Plano City Council is scheduled to vote on the tax rate and budget for 2018/2019 on September 10th. That is the same day as Rosh Hashanah (the Jewish New Year). That holiday is one of the holiest days in the Jewish Calendar. Jews from all over the world celebrate this holiday whether they are religious or not. At the time the council will be voting on the tax rate, Jews will be having their holiday dinner or attending synagogue. Naturally, Plano's Jews will not be able to go to city hall for the vote. This means a good portion of citizens will not be able to attend. Plano is home to four synagogues and one Jewish Center. If there were not a large Jewish population there would not be four, as most cities don't have any synagogues. Plano thinks of itself as a diverse and inclusive city; however, when Plano City Hall picks the day to hold a very important vote on a major Jewish holiday, they are not being inclusive. When this was brought to the City Council's attention they did not apologize or consider changing the day of the vote. This is not the first time the city has scheduled a public meeting that Jews would not be able to attend. The city council always holds their budget workshops on Saturday mornings, the Sabbath for Jews. Orthodox and some Conservative Jews can't even ride in a car on the Sabbath or major holidays, so they definitely will not go to city hall on those days, leaving them out of the meetings. I don't think the city government is purposely excluding Jews from public meetings. However, I do think they are being ignorant and insensitive to some of the residents in Plano. In the future, I recommend the city look up the Jewish Calender, so they will know when not to schedule important workshops, city council public hearings, and important votes. This way everyone who would like to attend these event would be able to. La Shanah Tovah to all our Jewish Friends This is Plano's Political Pit Bull Signing Off. By Planos' Citizens Coalition The second and FINAL public hearing on the Plano city budget is Wednesday, September 5 at 6:30pm at the Plano Municipal Center, located at 1520 K Avenue. NOW is the time to speak up and let your voice be heard. It’s now or never. You can do so by: Telling Plano City Council to not raise your city taxes by signing the informal Empower Texans petition (access by clicking the link. https://action.empowertexans.com/planotaxrate The petition was presented to each city council member with 557 signatures at the last meeting. Let’s double that number! Sign the Petition: Tell the City Council to Adopt the Effective Tax Rate Voicing your protest in person or by telephone. If you would like to speak before City Council on Wednesday or just register your opposition, you can call the City Secretary's Assistant, Alice at (972) 941-7515. She will record your opinion or speaker card. Tell Alice that you want to register your opinion on Public Hearing Item #1. Council should vote "No" to the proposed tax rate of $0.4603 cents. Let them know you want them to cut the property tax rate by 3 cents (effective tax rate). Emailing your opposition of the proposed tax rate to Plano City Council Members. You can reach all city council members directly at: [email protected] Or you may also contact city council members individually at: Mayor Harry LaRosiliere: [email protected] Ron Kelley: [email protected] Angela Miner: [email protected] Anthony Ricciardelli: [email protected] Rick Grady: [email protected] Kayci Prince: [email protected] Rick Smith: [email protected] Tom Harrison: [email protected] Remember, the effective tax rate IS doable regardless of what they tell you. It is up to us to insist on it. By the way, it will not require they cut any city services, jobs, or incur debt. Those are scare tactics used to silence taxpayers.  During public testimony this week, Jamee Jolly claimed the chamber’s member businesses support the city’s proposed property tax The following article is by Ross Kecseg of Empower Texans. Plano's Political Pit Bull adds to the article at the bottom. “This week, the head of the Plano Chamber of Commerce came out in support of the city’s proposed 4.5 percent property tax hike. If approved, the average Plano homeowner will see a 40 percent increase in their city tax bill in only five years. At Monday’s city council meeting, officials conducted the first public hearing on the city’s proposed tax hike. State law requires cities to hold two public hearings when proposing a tax increase. More than 40 citizens expressed opposition to the tax increase at the meeting. In addition to half a dozen speakers opposing the tax increase with persuasive testimony – including Mark Reid of the Plano Citizens Coalition –more than 570 petitions from residents were presented to council asking them not to raise their city tax bills. Over the past four years, the average Plano homeowner has seen their city property tax bill increase by 36 percent, according to city records. If passed, the proposed increase would push that figure over 40 percent in just five years. Higher city taxes are the result of council failing to reduce its city tax rate enough to offset skyrocketing property values. The city makes up roughly 20 percent of the average homeowner’s total property tax bill. Jim Dillavou, a Plano resident and retired CPA, gave compelling testimony when he cited city data comparing the city’s tax revenue growth to its resident population. While city property tax revenues have increased 46.5 percent since 2014, Plano’s resident population has only risen 5.7 percent. Dillavou asked, “Why should tax revenue rise eight times faster than the city’s population?” Only four individuals expressed their support for the tax increase, including Plano Chamber of Commerce President and CEO, Jamee Jolly. Jolly suggested her member businesses consider the proposed tax hike an “investment.” No business owner was present to speak on behalf of the increase. Jolly also referenced a “survey” of Plano residents that indicated they were satisfied with city services.” In this humble Pit Bull's opinion, Jolly's claim that her members want a property tax increase is ridiculous. If this is true, Jolly and Plano business owners need an economics class. If business property gets a tax increase, they must pass that increase on to their customers with higher prices. Higher prices mean customers buy less, or go to a cheaper competitor. Jolly has also forgotten that the more residents have to pay in taxes, the less disposable income they will have. The less money residents have, the less they will spend in businesses. So why would Jolly be in-favor of higher taxes? In two words: economic development. Jolly wants hand outs for large corporations who want to come to Plano; however, these handouts and higher taxes reduce customers' income. One would think the President of the Chamber of Commerce would care more about her members and their customers then moving in the competition. This is Plano's Political Pit Bull Signing off. " The following is from The Plano Citizens' Coalition. The members of their city budget committee have been combing through the budget. They have found line items that have not been used in over three years. They also found wasteful line items. Plano Citizens' Coalition members sat down with the city staff and council members, and gave them suggestions of things that can be cut or reduced in the budget. Their budget committee is made up of accountants, teachers, tech professionals, business men, and moms. All are residents of Plano.

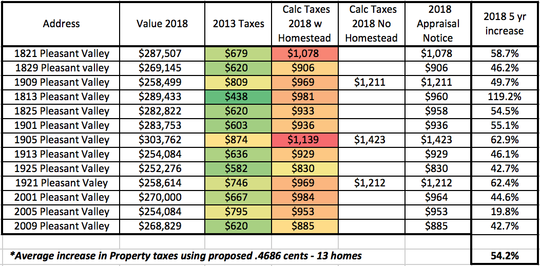

Enjoy This is Plano's Political Pit Bull Signing Off. "After the budget workshop meeting on Saturday, August 18 and other disinformation being bandied about by the city’s apologists, this battle boils down to a few very simple facts. Plano taxpayers have seen their city tax bills increase at more than five times the rate of inflation, increasing the City Property taxes on the average home in Plano by 39.7% in the last five years. This is unsustainable … it has to stop … adopting the Effective Tax Rate (ETR) does this. Adopting the ETR means that the city would have to find a way to survive with only about a 3.6% increase in property tax collections (approximately $7 million from new properties) rather than a 7.1% increase in its property tax budget (approximately $13 million). After increasing the city’s property tax collections by over 39% in the past four years, there is no reason that the city can’t slow down and live with only a $7 million (3.9%) increase for next year. It’s not complicated. It’s not about carry forwards. It’s not about sales taxes (which are forecast to be $5 million over budget in 2018). In fact, one of the issues is that the budget only includes $79 million for sales tax collections for next year even though actual collections have been at least $85 million for the last 12 months. This intentional under-budgeting of sales tax revenue is part of what causes the city to say it needs to collect more property taxes and cannot reduce the property tax rate. It’s not about restricted account funds - the City has over $500 million of cash and investments. It’s about competent management. It’s about our city council making our city management, exercise fiscal constraint. It’s about our city council providing oversight and representing the taxpayers of Plano. In addition, the city wants to increase our water rates by 12% and sewage by 5% which is totally unnecessary. Yet they paid an outside firm $21,000 for a several hundred-page report to justify over-charging us for water. The city charges the water and sewer fund $8.7 million for the right to do business in the city, saying that is what they would charge a privately-owned water utility, similar to how they charge Atmos Energy) the gas utility). There are no costs associated with this franchise fee, it’s just another way to get revenue from the citizens. Similarly, they charge $1.8 million as a charge in lieu of property taxes but government-owned properties are not charged property taxes in Texas. These and other made up charges to the Water & Sewer Department are a hidden tax. When the city says our property taxes are low, you need to add another 4 cents to the rate to account for these hidden taxes. Now is the time to speak up/show up. City council needs to know you are paying attention. Mayor Harry said he expects only 2 people to show up. Let’s pack the auditorium! The first public hearing on the budget is Monday, August 27 at 7pm. The second public hearing on the budget is Wednesday, September 5 at 6:30pm. Let them know you want them to cut the property tax rate by 3 cents (effective tax rate). It IS doable regardless of what they tell you. It is up to us to insist on it. BTW, it will not require they cut any city services, jobs, or incur debt. Those are scare tactics used to silence taxpayers. If you would like to speak on Monday or just register your opposition, you can call the City Secretary's Assistant, Alice at (972) 941-7515. She will record your opinion or speaker card. Tell Alice that you want to register your opinion on Public Hearing Item #1. Council should vote "No" to the proposed tax rate of $0.4603 cents. This is the first of two required public hearings on the proposed tax revenue increase. The second public hearing will be held on September 5, 2018 at 6:30 p.m. You can reach all city council members directly at: [email protected] or You may also contact city council members individually at: Mayor Harry LaRosilere: [email protected], 972-941-7107 Ron Kelley: [email protected], (972) 941-7107 Angela Miner: [email protected], 972-941-7107 Anthony Ricciardelli: [email protected], 972-941-7107 Rick Grady: [email protected], 972-941-7107 Kayci Prince: [email protected], 972-941-7107"  On Monday, Aug. 13, 2018, the City Council had decided what tax rate they would publish in the newspapers. Once it is published the city will hold two public hearings on the tax rate. At these hearings the residents can voice their opinions about the published rate. Finally, the Council will vote on the new tax rate for 2019 in September of this year. The tax rate they had agreed to be published was a rate of 0.4603 cents per $100 of assessed value for property taxes for 2019. It was a compromise between the current tax rate of $0.4686 and the effective tax rate of 0.4405 suggested by Councilman Ron Kelly. So, what does this possible new rate mean for taxpayers? It means, if this rate passes, your city taxes will go up again in January; however, the good news is, your taxes won't go up as much as they would have if the rate was kept at 0.4686 cents. To arrive at the rate of 0.4603 Councilman Kelly took the effective rate of 0.4405 and added population growth (.8%) and the rate of inflation (3.7%) according to the Municipal Cost Index. According to the US Labor Department, however, the current inflation rate is 2.9% from July 2017 to July 2018. Councilman Kelly stated his tax rate formula has been used by other cities in an effort to validate his method, yet the Mayor was not in favor of lowering the rate or using the above formula. Council members Prince, Kelly, Harrison, Smith and, Ricciardelli, though, all agreed to publish the rate of 0.4603 in the papers. Some residents who spoke at the Aug. 13th meeting had said they did not mind keeping the rate the same as last year. I guess those in favor of the 2018 rate can afford a higher tax bill in 2019. If they want to pay more, the City Treasury would be happy to take a donation, but other residents are struggling to pay their property tax bills now and need a lowered tax rate for 2019. For the last 5 years, city property tax bills have gone up about 35%; however, inflation has only gone up about 8%. Furthermore, since 2014, spending in General Government has gone up 69.5%; that is almost double than any other Plano City Department (See Chart). Unfortunately, resident wages have not gone up 69.5% or 35% over the same time period. If this trend of tax and spend keeps going on, in another 5 years property taxes will go up about 70% and the General Government will go up 139%. Imagine having to pay almost double the amount of taxes in 2023 then you did in 2014. For a middle-class family, this is unsustainable; some residents worry they will be taxed out of their homes and out of Plano. If the City Council continues to tax residents as they currently are, the only people who will be able to afford to own a home in Plano will be the rich and seniors who get a tax freeze now. However, middle-class families will be forced out. If you need the City Council to slow the rate of spending, save your house, and cut the rate 0.3 cents, go to the following link: https://action.empowertexans.com/planotaxrate. We will be doing an article on where to reduce government spending soon. This is Plano's Political Pit Bull Signing Off. It has come to this sites attention that people are wondering who Plano's Political Pit Bull is. Some people have started guessing names. Whoever's name they guess it will be wrong. Plano's Political Pit Bull is not just one person. It is a team of people. We have a group of like-minded residents who help with this site. We have people who edit the writing. We have a person who makes our videos and edits them. We have people who narrate our video scripts. We have folks who do research for our posts. Our team has people on it who know economics, history, and technology.

Everyone who helps with this site cares about Plano. They are tired of the local government ignoring the residents. Our folks hate the fact that the city gives taxpayer money to large corporations and developers while residents struggle to keep a roof over their heads. They are sick of the Plano media only copy and pasting the Mayor and city staff's talking points in their papers. That is the reason this site started in 2016. Residents realized that if they only read the local Plano papers, they were only getting half the story. Sometimes the papers would ignore important things that happened at city council meetings. So this site was born to give residents of Plano another option and a different opinion. When this site started we decided not to divulge the names of the people on the Plano's Political Pit Bull team. There are evil people in the world who would not hesitate to harass, assault and, even try to kill those who disagree with them. Just look at the news and you will see example after example of this, the following being only a few recent examples. Sarah Sanders and her family harassed while eating dinner at a restaurant, a grown man assaulting a teen for wearing a Make America Great Again hat, another man being kicked out of a coffee shop for wearing a Trump hat, a Jewish man having his car vandalized because he is a Trump supporter, Congressional Republicans almost killed by a Democrat while practicing baseball, an angry mob in Berkeley, CA smashes the windows of a college because they don't agree with the speaker, a person wishing for a pre-teen boy to get molested because his father is President Trump, and the list goes on and on. Obviously, our team did not want to worry about their safety and/or the safety of their families everytime they went out. So we keep the identities of the Pit Bull team private. In the end, the identities of our team do not matter. What matters is what we post. We do our best to get our information right, and if we make a factual mistake we try to correct it as soon as possible. Maybe when people don't feel it necessary to attack others for having different opinions the PPPB team can reveal their identities, but until then we will remain private. We hope you all enjoy reading and watching our posts, and for everyone to hopefully learn something new when coming on to our site. This is Plano's Political Pit Bull signing off. On Aug 11th and Aug 13th PPPB posted two articles on Plano's water. Plano Pocketing Money From Water. (https://planospoliticalpitbull.weebly.com/posts-about-council/plano-pocketing-money-from-water)

and More Water Profits Found. (https://planospoliticalpitbull.weebly.com/posts-about-council/more-water-profits-found) The city has responded to these findings with the following letter. "Thank you for your questions regarding all the transfers made from the Water & Sewer Fund. I wanted to pass on the response from Willdan & Associates our Rate Model Consultants regarding the transfer to the General Fund and the philosophy behind it. Willdan completed our Rate Model last November 2017. “It is unfortunate but not that uncommon that ratepayers sometimes think that municipally-owned water and wastewater utilities such as Plano are making a “profit”. Nothing could be further from the truth. The City of Plano only recovers from its ratepayers those revenues required to fund its water and wastewater operating and capital costs. As is common practice for thousands of utilities across the USA, this cost includes a transfer to the General Fund to reimburse other city departments (administration, public works, engineering, police/fire, etc.) for the very significant cost each department incurs in providing services to support the utility operation. If such a transfer were not made, then the General Fund would essentially be subsidizing the water and sewer fund through the provision of costs and services without reimbursement. The common amount of General Fund transfer for many cities is 10-15% of gross utility revenues, which is precisely where Plano’s General Fund transfer is positioned. While not all cities make a general fund transfer, financial and utility professionals across the USA consider these transfers to be prudent financial management and best practices. Plano uses the revenues it recovers from its water and wastewater fund to pay operating expenses and make the capital expenditures necessary to ensure that the system operates at an acceptable level of service. Projecting revenues can be inexact, as revenues are dependent on unpredictable weather patterns (for example, people purchase more water during hot dry months than cool wet months). If in any given year Plano recovers more revenues than all its costs, including its reimbursement of the General Fund, then this additional revenue is simply used for utility capital expenditures. There are no profits, no stock dividends, and no use of these funds for any purpose other than the provision of water and wastewater service.” In addition, the transfer from the Water & Sewer Fund to Capital Maintenance Fund is for two primary purposes: 1. Paying for Pump Station Rehabilitation (replacement of pumps and motors) and Water Design Standard Updates. 2. Paying for facility projects that either tie directly to the utility system (such as roof replacements at lift stations or emergency generator replacements at pump stations) or where utility system personnel have a substantial presence (Parkway Service Center, Municipal Center etc.). Our transfer to the Technology Services Fund is to pay for the portion of the staff, operations, and equipment for Technology that is specifically dedicated to Water & Sewer items. Let me know if you have additional questions. Thanks, Karen [Budget Dircetor] " While this letter was meant to answer questions, it only leaves me with more. Why do we need Consultants Willdan & Associates? How much do we have to pay for them? If transfers to the General Fund only covers operations coasts, why are these costs not listed under water and sewer operations? What does the department of administration, public works, engineering, police/fire, and others do for water and sewer that they need reimbursement? What are all the capital expenditures that Plano is spending this money on? Is this all for water and sewer projects? If the money from water and sewer is put into other funds for things related to water, how does the city earmark the money to make sure it only gets spent on water? The simplest way to make sure that water money is only spent on things related to water is for the city to specifically list what every penny of water money is spent on, and why, in the budget. But, of course, that would be too easy and transparent for the government to do. This is Plano's Political Pit Bull Signing Off. On Tuesday Aug. 14, 2018, District Judge Mark Rusch ruled that the recall petition for Councilman Tom Harrison is invalid. Judge Rusch determined that the petition did not have the required number of signatures. He based his ruling off of the original City Charter filed with the Texas Secretary of State in 1961. That Charter says the amount of signatures a recall petition has to have will be based off the number of voters in the last municipal election. Since the petition organizers (Democrat Ann Bacchus and Planning and Zoning Mayor appointee and socialist Michael Thomas) did not collect enough signatures, the petition was not valid. Judge Rusch also ordered the City of Plano to pay Councilman Tom Harrison $3000 for attorney fees, and vote to cancel the recall election at the next City Council meeting. The next meeting will be this Saturday, Aug. 18, 2018, at 8:00 am. This meeting was already scheduled as a 2018/2019 budget work session for council. The council has added, “Consideration of an Ordinance to rescind Ordinance No. 2018-4-3, canceling a Special Election to be held on November 6, 2018.” to the agenda. So this long saga that began in February with an offensive Facebook post will finally come to an end on Saturday. Now we have another problem that must be fixed. The City of Plano has been following an invalid charter for 50 years. That must be resolved before we can move forward. I wrote about the dueling charters in the post The City Of Plano Files A Lawsuit Against Itself which you can read at https://planospoliticalpitbull.weebly.com/posts-about-council/the-city-of-plano-files-a-lawsuit-against-itself . In that post I wrote….. “What if Article 6 is not the only article with different words between the two Charters? The City Charter is basically the Constitution of the City. It is the foundation of how the City is to be organized and run. Suppose that the city has been using the wrong Charter for over fifty years. If that is true, it would have huge legal ramifications. So that we can understand the magnitude of these ramifications, let's look at the following hypothetical. What if this new found Charter says that all ordinances must pass the City Council by a super majority. However, the Charter the city has been following only calls for a simple majority to pass an ordinance. If the newly discovered Charter turns out to be the “true” Charter, every ordinance passed by a simple majority since 1961 could be thrown out. If we have been using the wrong Charter, that also means we have been amending the wrong Charter. Therefore, all of the amendments that have passed could get thrown out. One of those amendments was the number of city council members the city should have. In 1961 we only had five council members and a Mayor. If we have amended the wrong Charter, can we conclude that we have the wrong number of City Council members? What happens to the two extra we have now? Would their elections even be valid? Would they have to step down from Council until a new Charter election takes place? If two have to step down, which two would it be? According to the two 1961 Charters, Council members did not have place numbers, so how would the city decide who steps down? I don't know the answers to any of these questions. The one thing I do know is the discovery of this second Charter has the potential of throwing the City into its own constitutional crisis.” This is Plano's Political Pit Bull Signing Off. The above chart comes right from the City of Plano. It shows the city profits from water. It also shows the city takes the profits and transfers it to non-water funds. This is morally wrong!

This is Plano's Political Pit Bull Signing off.

The following is written by a guest of this site. Anyone is welcome to leave a comment in the comment section. Any comments that are disrespectful to anyone, mean in nature, not about this articles content, or meant to stop discussion will be removed from this page. This is a private web page. I am not the government, so the 1st amendment does not apply here. Plano's Political Pit Bull The following was written By Mark Reid President of Plano Citizens Coalition City of Plano property taxes are increasing at an unsustainable rate. In the last five years, according to the city’s own data, the average homeowner has seen their city tax bill rise 36 percent, while inflation has increased only 16 percent. This is a direct result of city officials refusing to reduce their tax rate enough to offset rising property values. Plano city leaders will argue about the tax rate. They will say that the tax rate is the same as it was ten years ago or that they lowered the tax rate two years ago, but that is irrelevant when property values are increasing faster than the tax rates are decreasing. For example, if over the last ten years your $250,000 home increases in value to $400,000, that is a 60% increase. If over that time, the tax rate stays the same, the property taxes you pay would go up 60%. If over that time, the tax rate dropped two cents per hundred dollar valuation, which is about 4%, then the property taxes you pay would go up 53%. The increase is less, but still unsustainable. City staff has proposed yet another 4 percent tax increase again this year. And they’re using confusion to try and convince residents they aren’t. They say they are “not raising the tax rate,” implying they aren’t forcing taxpayers to pay more. But the truth is, they are. The solution is for the Plano City Council to adopt the “Effective Tax Rate” which is the tax rate at which, on average, homeowner would pay the same amount of tax this year as they paid last year. As always, even with a lower tax rate, the city would still collect additional revenue from the city’s growth, but the tax hikes on existing homeowners would stop. This seems quite reasonable after a decade of annual tax increases. The city will predict dire consequences if they are not allowed to continue on their tax-hiking path, but a committee of concerned Plano citizens has been studying past budgets for several months, and is now studying the proposed 2018-2019 budget. All that’s required to enable adoption of the Effective Tax Rate, and reduce the property tax rate by roughly 3 cents, is for the city to grow its budget at a slower rate than before. No spending cuts are required to lower the tax rate. If the city simply increased spending at a slower rate, they could easily lower the tax rate. There are many areas in the budget that year after year are budgeted at levels millions of dollars more than are actually spent when the year is over. In other words, city staff will ask for millions more in each department than what they actually need. Yet, each year these line items are increased over their previous year’s budget, rather than over the previous year’s actual expenditures. Eliminating this shell game alone will allow the city to adopt the Effective Tax Rate. Again, no spending cuts are required. Even at a lower tax rate, total tax revenue and spending will still increase. Our committee will work with any City Council member that has an interest in our findings and is willing to consider reasonable ideas to stop unsustainable spending and property tax hikes in the City of Plano. The City of Plano uses homeowners to make a HUGE profit on water. Plano buys water from the North Texas Municipal Water District (NTMWD) at “wholesale” prices and sells it to Plano taxpayers at “retail” prices. According to page 57 of the 2018/2019 City Managers Recommended Budget, selling residents water at retail prices generates millions of dollars in profit every year. The city transfers the profits to multiple funds. The fund that gets most of the profits is the General Fund. In the fiscal year of 2015/2016 the city transferred over 17 million to the General fund. In 2017/2018 the city is estimating to put over 17 million in the General fund. For 2018/2019 the city is projecting to put over 18 million in the General. All of this money is from water/sewer profits. Other cities don't make a profit on water. Plano does not do anything to the water to clean it or make it taste better. The water taste terrible. Residents complain that the water makes them and their pets sick during the months the NTMWD choline burns the pipes. Residents also say the water causes skin problems during that time. So why do they need to overcharge residents for water? Plano also got a rebate of 2-4 million dollars form NTMWD. The city did not pass that rebate on to the people who actually paid for the horrible water. So what does the city do with the large windfall it makes off of water? Well, one year, the city used this profit to cover a $12,000,000 renovation of West Plano's sewer lift. Now, I know what you're thinking. Doesn't the city have to pay for sewer lift upgrades? This would be correct, however the only reason the lift needed upgrading was because of a certain development we didn't want; Legacy West. The city should have billed the developer of Legacy West, instead of using the Plano citizens' money. Instead of using the money, the city made by gouging the residents, to lower Property Taxes to the effective tax rate (which would take $12,000,000), the city saved a wealthy developer, $12,000,000. So while you are wondering how you are going to pay for a higher tax bill in January, the city is raking in the money from your water bill and giving it to wealthy corporations and developers. This is something I would expect from politicians in DC. Since our local politicians and bureaucrats behaves like those in Washington DC, perhaps we should change the name of Plano to Washington DP (District of Plano.) This is Plano's Political Pit Bull Signing off. To read the budget for yourself go to http://plano.gov/DocumentCenter/View/32268/2018-19-CITY-MANAGERS-REC-BUDGET?bidId= It’s common to find a home in Plano that went from $250k in taxable value to $400k, in last 10 years. That Plano homeowner now pays:

58% higher property taxes to City of Plano Inflation over that same period was only 16%. Cause: MOST local officials are not lowering property tax rates enough to offset higher home values - Looks like the Plano City Council needs to significantly LOWER their property tax rate this year to the effective tax rate. That means the amount we pay to the city in 2019 is the same as last year. The city will still collect more money in 2018/19 because new properties came online. Council is debating this topic right now, and will make the final decision in early Sept. On July 23, 2018, after a long drawn out City Council meeting, the Envision Oak Point Plan passed by a vote of 6-2. Councilmen Tom Harrison and Anthony Ricciardelli were the dissenting votes. In case you don't know what Envision Oak Point is, please read my other articles titled Oak Point May Be Coming Back From the Dead https://planospoliticalpitbull.weebly.com/posts-about-council/oak-point-may-be-coming-back-from-the-dead and Envision Oak Point Update https://planospoliticalpitbull.weebly.com/posts-about-council/june-21st-2018 . You may also watch my video and first post about the plan, The Oak Point Plan is Dead https://planospoliticalpitbull.weebly.com/videos.html . The plan was the ninth and last item on the agenda. People who went to the meeting to voice their opinions had to wait until almost 10 pm to be heard. Coincidence, I think not. More often then not controversial items are put last on a full agenda. Nine people spoke and twelve filled out a card in favor of the plan. Some of the people in favor of the plan said it was a vision and would guide new development. The President of the Plano Chamber of Commerce said, "It reaffirms that the City of Plano is open for business." So, somehow companies like Toyota, Liberty Mutual, and Boeing don't reaffirm the message that Plano is open for business? Maybe we should put an open sign on our border for those who still don't know. Forty-three people filled out a card against the plan, and fifteen people spoke against it. Two moved to East Plano for a more rural and quiet life; they don't want to lose that. One of those people did not appreciate the other side calling him a racist just because he was opposed to the plan. Other residents worry about the number of housing units that would be built. Currently, the plan calls for 3000 housing units. The types of homes would be single family on small lots, condos, townhouses, small cottage homes under 1000 square feet, and of course apartments. Residents who spoke worry that this area would become too crowded. That it would lead to more traffic and cause over crowding in schools. Unfortunately, the one thing the plan does not have is a new school. Two residents talked about letting the free market and residents decide what should be built instead of government bureaucrats; people after my own doggy heart. To reduce the amount of density, the majority of the people who spoke against the plan asked for it to be tabled. After the public spoke it was the councils turn. Councilwoman Angela Minor read from a prepared speech. Clearly she did not care what any of the residents said. Since she refused to listen to anyone, I am going to skip her remarks and go to the next councilman who spoke. Councilman Rick Smith said, “It seems that we as a city have not done a good enough job educating the public about the plan'…'I think there is some very good things about this plan. To get good quality revitalization and redevelopment going on the East side'…'It seems everything has zeroed in on high density housing. I feel like if that we're not in the plan, I don't think everybody would be fighting'…'I think generally everyone agrees that we do need some type of revitalization, refreshing on the east side.” He is right about one thing; if the density is taken out the people would be much happier, and maybe not as opposed to the plan as they are now. Councilman Anthony Ricciardelli spoke next. He said, “There is so much good in Envision Oak Point. Revitalization of Plano Market Square Mall, the Ave K corridor, [and] affordable single family neighborhoods'…'There is so much good, yet I continue to have reservations about the housing density and the density of development in general'…'It seems that one thing that keeps coming up [from the people] is housing density.” Councilman Anthony Ricciardelli also talked about how one residents words resonated with him. “The plan talks about a community vision, and there are many areas of this plan in which we do have a community vision'…'That [must be a] vision that is broadly shared by a super majority of the community. Something that we can rally around and move forward on. But a vision is not a vision if it is 51/49 or worse yet 40/60. That is not something we can all rally around. That is not a statement for moving forward together'…'It has become clear to me that the high density is the critical sticking point [with] the community. I think if we were able to take that out and express no opinion on high density development in this plan, and leave that to individual zoning cases in the future, what is left is a broadly agreed upon vision that the community can rally around…'I think it is important to make a statement that we want and need revitalization and reinvestment in the Oak Point area and in East Plano'…'I think the inescapable conclusion is that the community is divided about the density of development in this plan'…'This is a plan we need to move forward on, but we need to move forward united. We can't move forward united if the plan contains a strong statement in favor of high density development.” While I agree that the community needs to be united on what it wants, I don't agree that we need government inference to make redevelopment happen. Councilman Ricciardelli also wanted to make modifications to the plan, but the Mayor put a stop to it. Councilman Harrison went next. “I think the plan is probably a very very good plan expect for one thing. I think if you go with retail, restaurants, and redevelopment you have a winner. The problem I have is high density. Three years ago I ran for this office on two things, high density and apartments. It involved cars, traffic, and education/PISD and what it was doing to residents. This plan is doing the same thing. We had two people talk about PISD, and we had about four people talk about traffic. The other thing that bothers me is the infrastructure that was built in East Plano was done with a comprehensive plan forty years ago. That is why we have to build a new [sewer] lift station by 121 and the Dallas North Tollway, because some of the infrastructure (sewer and water) is old and is getting dilapidated and needs to get repaired.” It also was not built with the Shops at Legacy and Legacy West in mind. That just proves that we cannot predict what will happen 30 years from now. He went on to say, “That is a thing we have not really thought about, because as we add people in Plano East we are going to put more strain on sewer and water. Those are the reasons I can't bring myself to vote for this plan.” In other words, Envision Oak Point plans for more people, but does not plan for things those people will need. East Plano's infrastructure is simply not equipped to handle 3000 new housing units. After Councilman Harrison finished his comments, the Mayor did something very fishy. He recessed the council into a private executive session. Now, why would the Mayor do that? Could it be he was worried that four council members were going to vote no and kill the plan? Council members Smith, Harrison, and Ricciardelli statements made it seem like they were 'no' votes. Could it be the Mayor wanted to twist some arms to make sure this plan passed? I would not put it passed the Mayor to resort to bully tactics just to get his way. He bullies residents, so why not council members? Reportedly, Councilman Grady was so upset that the plan might fail he started cursing his fellow council members out. Now, why would he get so mad? Could it be he has some kind of invested interest in seeing the plan implemented? The council were recessed from 11:22 pm – 11:48 pm. When they reconvened the Mayor said, “We broke into executive session to discuss legal matters.” If you believe they only broke to discuss legal matters, I have a bridge in Brooklyn to sell you. After they returned Councilwoman Prince started her comments. “Two people mentioned that it is important to let the free market determine what happens. To that end, I think that is why it is important to have a variety of housing options included in this plan.” Although, technically those people said, “The free market and the residents.” She then went on to say, “Since we don't know exactly what is going to happen 10, 15, or 20 years down the road, I think it is important to have all the options on the table.” Someone should tell Councilwoman Prince that leaving development up to the residents and the free market does not take anything off the table. If the market and residents have a call for something, a developer will come along to fill it. She then appeared to go on to read from a written statement saying, “I think Plano has been fortunate to enjoy many years of success. It is easy to take that for granted, and assume that we will always be successful. Success is not guaranteed, and it is up to us as leaders to put a plan in place that will help insure that our city is economically viable and attractive to citizens in the future. I believe this plan attempts to balance the needs and views of a diverse group of citizens living in Plano today and the future.” Did she zone out during the residents comments? It seemed like she missed all the people who have problems with the plan, and their views were not listened to. She ended her comments with, “Cities with vision become cities that thrive, and because I want Plano to always be a city that thrives I will be supporting the vision tonight.” While there has not been a “plan” specifically for this area, Plano has had comprehensive plans before. For example, the Plano Tomorrow Plan which is currently in place. The city has created many plans that have failed East Plano, and will continue to fail. It is like we are driving towards a cliff and the driver (government) thinks the car just needs more gas. I have a better idea, the government needs get out of the car and leave the driving to the residents. Councilman Ron Kelly spoke next. He started with a question for the City Attorney, in which he asked her, “Is this a zoning case?” She said, “No.” He then quoted a resident who said, “Plano has always had vision…Some recent examples of that are Legacy West. It started with a vision.” Apparently it forgot to vision a lift station. “The resurgent of downtown Plano started with a vision…'Make no mistake about it, our actions tonight creates no zoning changes, and no development plans.” He also stated he has talked to residents from the area who had their homes go down in valve. “I think we can do much much better in that part of town. I have done some research into what people are looking for today and there is a consistent theme. They are looking for neighborhoods that are loaded with amenities. They are also looking for civic gathering places. They are looking for retail, businesses, restaurants, green open space and envision oak point can do that.” Excuse me Councilman Kelly, the developer who built Frisco Lakes in Frisco already did that on his own. He also did not cram the people in like sardines to do it. People are also not all looking for the things Ron Kelly stated. Apparently he did not listen to the residents who spoke either; some people want to live a more rural lifestyle. For example, the people in Parker (the town right next to East Plano) move there for that specific lifestyle. Houses in Parker have to have a minimum number of acres. Yes, acres not feet. The people there prefer the wide open space, and would certainly not be happy to live somewhere with buildings every few feet. Councilman Kelly finished by saying he would be supporting this vision. Now the people who helped get Councilman Kelly elected are extremely hurt and upset with him. He got elected after the Plano Tomorrow Plan was passed; his supporters voted for him to stop high density things like this. Now the people that voted for him feel he turned his back on them and say he is a traitor. However, this is not the first time Councilman Kelly's supporters have been disappointed by him, for he has voted for three budgets and three tax rates that his voters were not happy with. Councilman Kelly is up for reelection in May 2019. With his support for this plan and other votes, I predict he wont be getting the same support he got in the last election. I predict if he does not start voting the way the people who put him in office want and expect him to, Councilman Kelly will not win re-election in 2019. Councilman Grady took his turn next. He started by saying, “Opportunity only knocks once'… 'You either have progress or you have regression'…'If you don't change others will pass you by'…'We need to be as progressive as possible'…'I really appreciate all of the input that everyone has put in either strongly one way or in strongly another.” He appreciates it so much he told his fellow councilmen that were against the plan, “F... you.” Councilmen Grady continued, “If we don't plan and determine things, then somebody else will.” Of course he does not tell us who this someone else is. He would prefer it if government did the planning. So, he supported the plan, and said it was a terrific piece of work. After Councilman Grady, Councilman Rick Smith spoke again. He said, “It is just a wish list'…'It is not being incorporated into our master plan [Plano Tomorrow Plan]'…'I want to see good things happen for the East side'…I am in support of this plan.” This shocked Councilman Rick Smith's supporters. He, too, was voted into office to stop high density, so his supporters also felt he turned is back on them. I must give Councilman Smith credit, however, for going up to the people who were unhappy with his vote and talking to them. He understood why they were upset, and he seemed sorry that he disappointed them. On the other hand, Councilman Kelly did not stay around to explain himself to those who were upset with him and his vote. Last but not least, the Mayor got his turn. The Mayor, yet again, did not care about what the residents had to say. He was for this plan from the beginning, and nothing was going to change his mind. He wants to make a Legacy West in East Plano. Personally I hate Legacy West; it is far too crowed for me. “We know how to do this [plan a development like Legacy West].” the Mayor said. Except when he planned for Legacy West he forgot about sewer and water for it. “[We] plan out in a thoughtful way.” He must mean thoughtful to people who want that kind of development. It is very unthoughtful to the people who don't like it. The Mayor then pointed out the gentleman who said he did not like the fact that he was being called a racist for simply opposing the plan. The Mayor said, “Not everyone who opposes Envision Oak Point is a racist but some are. When you equate high density and apartments with crime and bad schooling it's racist.” First of all Mayor, not everyone who is against high density or apartments are racist. South Lake does not have any apartments and does not want them. Does that make everyone in South Lake a racist? Of course not. Secondly, to allege that only minorities live in apartments and high density areas is completely racist. Who says only white people want to live in a rural or suburban area? Further more, people of all colors and backgrounds live in apartments. People who are worried about schools going down due to high density are not racist. They are worried the schools will become overcrowded. It is a fact that children in overcrowded schools do not do as well as children who don't. That has nothing to do with color; it has to do with the ratio of teachers to children. Here is another fact, the more people you have the more crime you have. Again that is just what the numbers tell us. It is one reason why people who compare crime rates of cities only look at cities with similar population sizes. It would also not be fair to compare Plano's crime rate with that of a city with only 1000 people. If they did, Plano would have the higher crime rate every time. It is also racist of the Mayor to allege that only minorities commit crimes. The last time I checked white people commit crimes too. I titled this piece, The Day Democracy Died, because more people were against the plan than were for it. If you did the math at the being of this post, you would have realized that 58 people were against the plan and 21 were for it. Even though the USA is a constitutional republic, we do hold elections democratically. If the people who were there last night voted on this plan, it would have failed by a landslide. That is only the people who filled out cards. More people emailed and called the council members to voice their opposition to the plan, however, those people's votes were not seen. Six of the council members ignored the results of the “vote”, and by ignoring the will of the people, they killed the last bit of Democracy in Plano. Why? The reason is the same in every oligarchy, they think they know what is best. This is Plano's Political Pit Bull CITY OF PLANO RAISES PROPERTY TAXES 36 PERCENT IN RECENT YEARS City officials have raised taxes dramatically on residents, despite a growing tax base driven by new commercial development.

On June 25, 2018, the City Council voted unanimously to lease five acres of city land for free, so Radisson could build a hotel on it. The land is next to the Plano Event Center. City staff believes that the new hotel will bring more business to the Plano Event Center and more tourist to Plano. Having a hotel next to the Event Center has been an 18-year goal for Mark Thompson, Executive Director of Visit Plano. Apparently, he has been trying to get a company to build a hotel for 18 years, but no one has agreed until now.